January 4, 2024

Consumer payment choices have been shifting with implications for state courts. For example, a January 2023 Trending Topic article discussed new off-site payment options that make payments easier than a lengthy trip in person to the courthouse. Such trips are not always easy for all individuals during standard business hours.

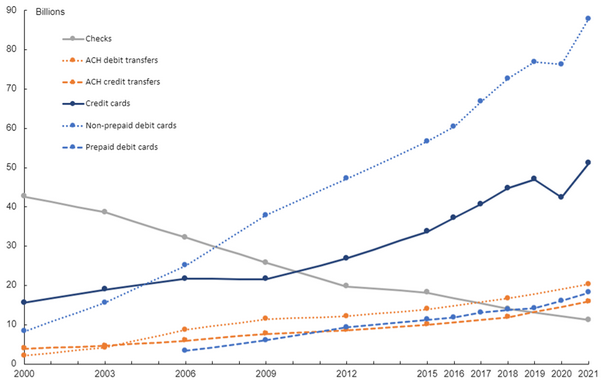

While off-site payments can involve cash, the overall trend in payment choices for all consumers for all types of purchases are moving steadily and strongly toward debit cards and credit cards and away from checks and cash. See Figure 1 from the 2022 Federal Reserve Payments Study, which charts payment amounts in billions by noncash payment method from 2000 to 2021.

Figure 1.

Checks (in gray) have seen a steady, rapid drop as a method of payment since 2000. Cards (in blue)—debit, credit, and prepaid—have seen a steady-to-strong increase, especially since 2012. Debit and credit payments from bank account numbers (in orange) have also seen an increase but not near that of debit and credit cards.

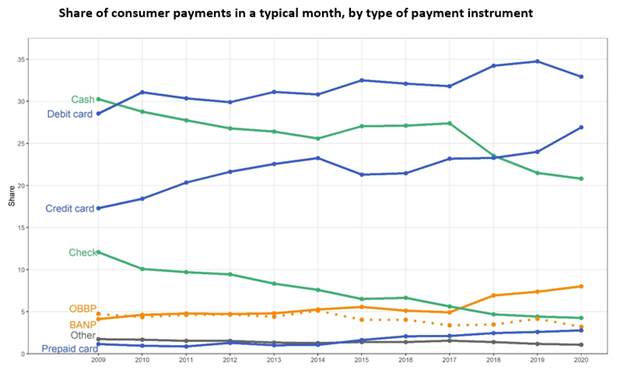

Also reflecting this overall trend on a household level, the Federal Reserve of Atlanta produces its annual Survey of Consumer Payment Choice that gives the share of consumer payments in a typical month by type of payment instrument (see Figure 2). In 2020 cash and checks (in green) showed a steady decline from 2009, while debit cards and credit cards (in blue) a general increase. On average consumers made 68 payments per month. The share of payments by debit cards was 23, by credit cards 18, and by cash 14.

Figure 2.

How does this affect state courts? The Washington Post sliced the Fed data by merchant type. Government payments include court fines and fees. Payments by consumers to government entities are check 27, cash 11, credit card 17, and debit card 15.

State courts are noticing these trends by adding debit and credit card payment options, whether in the courthouse or off-site locations, to help make paying court fines and fees more convenient for individuals.

Is your court considering updating its payment methods? Share your experiences with us at Knowledge@ncsc.org or call 800-616-6164. Follow the National Center for State Courts on Facebook, X, LinkedIn, and Vimeo. For more Trending Topic posts, visit ncsc.org/trendingtopics or subscribe to the LinkedIn newsletter.